Glossary of import and export terms

UPDATED JUNE 2025

The Trade Compliance and Logistics world has a huge number of acronyms, and it is ever-changing. This comprehensive list explains what some of these terms, abbreviations, and acronyms stand for, and their meanings within the context of trade and logistics. Understanding this specialised terminology and vocabulary is crucial for anyone involved in the industry.

Search for a term alphabetically:

A; B; C; D; E; F; G; H; I; J; K; L; M; N; O; P; Q; R; S; T; U; V; W; X; Y; Z

Or click on any acronym or term in the list below to jump to a detailed explanation.

Download the Glossary of Import and Export Terms (pdf format)

| 3PL/4PL | HTS | |

| AEO | IATA | |

| Incoterms | ||

| ATA Carnet | DPS | IOR |

| LoC | ||

| CCC Mark | ||

| CFR | ||

| EXW | POA | |

| FAS | RPS | |

| CPT | FOB | |

| C-TPAT | SDN | |

| DAF | FTA | SED |

| DDP | HS |

3PL / 4PL: Third-Party / Fourth-Party Logistics

Third-Party Logistics (3PL) involves outsourcing specific logistics functions, like warehousing and transportation, to a third-party provider. Fourth-Party Logistics (4PL) takes it a step further by providing comprehensive, end-to-end supply chain solutions, often including the management of 3PLs, technology implementation, and strategic consulting.

AEO: Authorised Economic Operator

An internationally recognized standard that certifies a business as reliable and compliant with customs regulations, ensuring a secure and efficient role in the international supply chain.

AES: Automated Export System

The Automated Export System (AES) is the system used by U.S. exporters to electronically declare their international exports (known as Electronic Export Information (EEI - see below) to the Census Bureau to help compile U.S. export and trade statistics.

AWB: Air Waybill

An air waybill (AWB) is a document that accompanies goods shipped by an international courier to provide detailed information about the shipment, and allow it to be tracked. The bill has multiple copies so that each party involved in the shipment can document it.

ATA Carnet: Admission Temporaire/Temporary Admission

An ATA Carnet is a customs document, often called a "passport for goods," that facilitates the temporary and duty-free import and export of goods. It simplifies customs procedures by allowing individuals or businesses to bring goods into a country temporarily, such as for trade fairs or exhibitions, without having to pay import duties or taxes. The Carnet acts as a guarantee that the goods will be re-exported within a specified timeframe, typically one year.

BOL (or B/L): Bill of Lading

A bill of lading is a document issued by a carrier to acknowledge receipt of cargo for shipment. In British English, the term relates to ship transport only, and in American English, to any type of transportation of goods.

BOM: Bill of Materials

A bill of materials or product structure is a list of the raw materials, sub-assemblies, intermediate assemblies, sub-components, parts, and the quantities of each needed to manufacture a product.

CBP: Customs & Border Protection

Customs and Border Protection (CBP) is the largest federal law enforcement agency of the United States Department of Homeland Security. It is charged with regulating and facilitating international trade, collecting import duties, and enforcing U.S. regulations, including trade, customs, and immigration. Other countries will have their own version of this.

CCC Mark: China Compulsory Certificate

The China Compulsory Certification (CCC), also known as the 3C mark, is a mandatory safety and quality mark for products that are imported, sold, or manufactured within China. It ensures that these products meet Chinese health, safety, environmental, and national security standards.

CI: Commercial Invoice

When used in foreign trade, a commercial invoice is a customs document. It is used as a customs declaration provided by the person or corporation that is exporting an item across international borders.

COC: Certificate of Conformity

Certificate of Conformity e.g., C.O.C. SASO. A Certificate of Conformity or CoC is a mandatory document which is necessary for Customs clearance of exports to many countries around the globe. Approval or Certificate of Conformity is granted to a product that meets a minimum set of regulatory, technical and safety requirements.

COO: Certificate of Origin

A certificate of origin (often abbreviated to C/O or CoO) is a document used in international trade. In a printed form or as an electronic document, it is completed by the exporter and certified by a recognized issuing body, attesting that the goods in a particular export shipment have been produced, manufactured or processed in a particular country.

C-TPAT: Customs Trade Partnership

A voluntary partnership program led by the U.S. Customs and Border Protection (CBP) that aims to enhance global supply chain security. It focuses on improving security practices within private companies' supply chains to mitigate terrorism risks. By participating, companies demonstrate their commitment to security and can receive benefits like reduced inspections and faster processing at ports of entry.

DEC: District Export Council

The National Association of District Export Councils (NADEC, formerly known as National DEC) consists of 16 District Export Council (DEC) members who have been elected to the NADEC by District Export Council members from each of the eight U.S. Department of Commerce - U.S. Commercial Service Networks.

DGN: Dangerous Goods Note

The Dangerous Goods Note (DGN) is a transport document that gives details about the contents of a consignment to carriers, receiving authorities and forwarders describing any goods that may be considered hazardous.

DGR: Dangerous Goods Regulations

Dangerous Goods Regulations (DGR) The IATA Dangerous Goods Regulations (DGR) is the trusted source to help you prepare and document dangerous shipments. Recognized by the world's airlines for almost 60 years, the DGR is the most complete, up-to-date, and user-friendly reference in the industry.

DPS: Denied Party Screening

Denied trade screening is the process of screening parties involved in an export transaction for complying with the safety standards of the U.S. Government. Effective trade screening not only includes denied parties but also controlled products and embargoed or sanctioned countries.

EAR: Export Administration Regulations

The International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR) are two important United States export control laws that affect the manufacturing, sales and distribution of technology. The legislation seeks to control access to specific types of technology and the associated data.

EAR99

EAR99 is a classification for an item. It indicates that an item is subject to the Export Administration Regulations (EAR), but not specifically described by an Export Control Classification Number (ECCN) on the Commerce Control List (CCL). Items that fall under the jurisdiction of the EAR but are not found on the Commerce Control List (CCL). Please see our Guide to ECCN Classifications for Dual / Controlled Use IT Goods.

ECCN: Export Control Classification Number

An Export Control Classification Number (ECCN) is an alphanumeric designation (i.e., 1A984 or 4A001) used in the Commerce Control List to identify items for export control purposes. An ECCN categorizes items based on the nature of the product, i.e. type of commodity, technology or software and its respective technical parameters. Please see our Guide to ECCN Classifications for Dual / Controlled Use IT Goods.

EEI: Electronic Export Information

The Electronic Export Information(EEI) is filed electronically in the Automated Export System (AES) or the Automated Export System Direct. This data is the electronic equivalent of the export data formerly collected as Shipper's Export Declaration (SED).

EMCP: Export Management and Compliance Program

An Export Management and Compliance Program is required by the U.S. Government to ensure that companies comply with export control policy for dual-use commodities, software, and technology.

EOR: Exporter of Record

The exporter of record (EOR) is noted as the owner or seller of merchandise being exported from an origin country location to a destination country. The Exporter of Record must be a registered entity in the receiving country. Read more about the role of the Exporter of Record and who can act in this role.

FCA (Free Carrier)

Free Carrier (named place of origin) The seller delivers the goods, cleared for export, at a named place (possibly including the seller's own premises). The goods can be delivered to a carrier nominated by the buyer, or to another party nominated by the buyer.

FF: Freight Forwarder

A freight forwarder, forwarder, or forwarding agent, also known as a non-vessel operating common carrier (NVOCC), is a person or company that organizes shipments for individuals or corporations to get goods from the manufacturer or producer to a market, customer or final point of distribution

FSB Notification

Federal Security Bureau (FSB). The international legislation of the Customs Union provides the restriction of special equipment, including products with encryption or cryptography into Russia. Product must be notified on the FSB database before the legal import of such goods into the Russian Federation.

FTA: Free Trade Agreement

Treaty (such as FTAA or NAFTA) between two or more countries to establish a free trade area where commerce in goods and services can be conducted across their common borders, without tariffs or hindrances but (in contrast to a common market) capital or labour may not move freely. Member countries usually impose a uniform tariff (called common external tariff) on trade with non-member countries

FTR: Foreign Trade Regulations

Trade regulation is a field of law, often bracketed with antitrust (as in the phrase “antitrust and trade regulation law”), including government regulation of unfair methods of competition and unfair or deceptive business acts or practices.

FTZ: Foreign Trade Zone

Definition of foreign-trade zone: an isolated policed area adjacent to a port of entry (as a seaport or airport) where foreign goods may be unloaded for immediate trans-shipment or stored, repacked, sorted, mixed, or otherwise manipulated without being subject to import duties.

HS: Harmonized System

The Harmonized Commodity Description and Coding System, also known as the Harmonized System of tariff nomenclature is an internationally standardised system of names and numbers to classify traded products.

HTS: Harmonized Tariff Schedule

An HS or HTS code stands for Harmonised System or Harmonised Tariff Schedule. Developed by the World Customs Organization (WCO), the codes are used to classify and define internationally traded goods.

IATA: International Air Transport Association

The International Air Transport Association is a trade association of the world's airlines. Consisting of 290 airlines, primarily major carriers, representing 117 countries, the IATA's member airlines account for carrying approximately 82% of total Available Seat Miles air traffic.

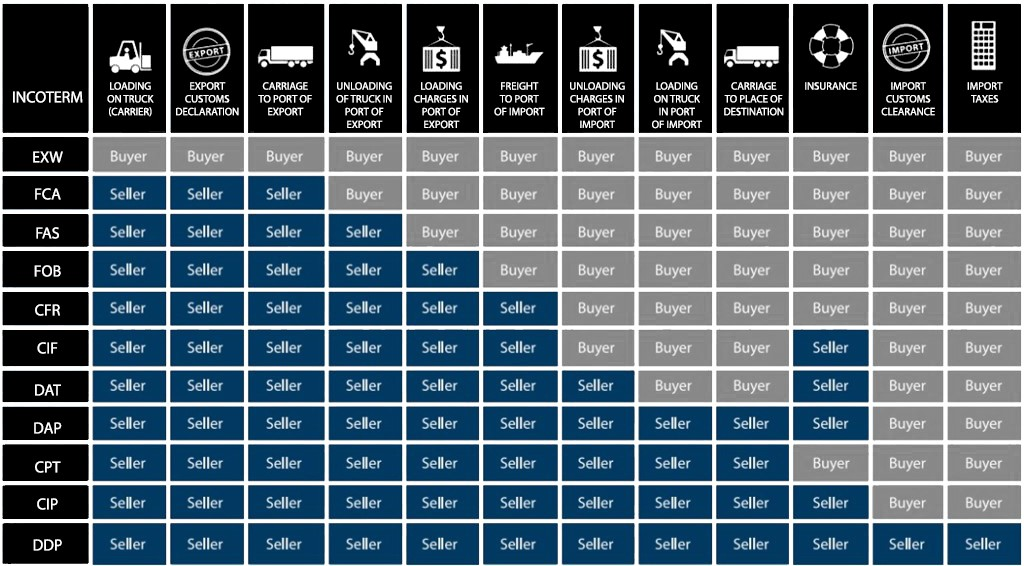

Incoterms:

Cost and Freight are paid at the named port of destination. The seller pays for the carriage of the goods up to the named port of destination. Risk transfers to buyer when the goods have been loaded on board the vessel in the country of Export.

This refers to an Incoterm meaning the buyer assumes all risk once the goods are onboard the vessel for the main carriage but does not assume costs until the freight arrives at the named port of destination. CIF applies to ocean or inland waterway transport only. It is commonly used for bulk cargo, oversized or overweight shipments.

Carriage and Insurance Paid To (CIP) is when a seller pays freight and insurance to deliver goods to a seller-appointed party at an agreed-upon location.

In a CPT transaction the seller delivers the goods to a carrier or to another person nominated by the seller, at a place mutually agreed upon by the buyer and seller, and that the seller pays the freight charges to transport the goods to the specified destination.

An older Incoterm which means the seller is responsible for delivering goods to a specified border crossing point, and the buyer is responsible for customs clearance and transportation from that point onward. DAF is no longer used in international shipping contracts and has been replaced by Delivered at Place (DAP) and Delivered at Terminal (DAT)

New Term - May be used for all transport modes. Seller delivers when the goods, once unloaded from the arriving means of transport, are placed at the disposal of the buyer at a named terminal at the named port or place of destination.

Delivered duty paid means that the seller fulfils his obligation to deliver when the goods have been made available at the named place in the country of importation. The seller must bear the risks and costs, including duties, taxes and other charges of delivering the goods thereto, cleared for importation.

An incoterm which means the seller delivers the goods to a specified location and unloads them. The seller bears all costs and risks until the goods are unloaded at the destination, and the buyer's responsibility begins from the point of unloading.

This term places the maximum obligation on the buyer and minimum obligations on the seller. The Ex Works term is often used when making an initial quotation for the sale of goods without any costs included. EXW means that a buyer incurs the risks for bringing the goods to their final destination.

A shipping term, specifically an Incoterm, used in international trade. It means the seller's responsibility ends when the goods are placed alongside the vessel at the port of shipment, ready for loading. The buyer then assumes all costs and risks, including loading the goods onto the ship.

Free on Board means that the seller fulfils his obligation to deliver when the goods have passed over the ship's rail at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that point.

IOR: Importer of Record

The importer of record (IOR) is officially noted by many governments as the owner or purchaser of merchandise being imported into a destination country.

ISF: Importer Security Filing

An Importer Security Filing (ISF), also known as the "10+2" rule, is a requirement for US Customs and Border Protection (CBP) to ensure the safe and secure entry of ocean cargo into the United States. It mandates that importers or their agents electronically submit specific data about their cargo to CBP at least 24 hours before the vessel's departure from the port of loading. This information is used to identify and track shipments, potentially reducing the risk of smuggling and other threats to US national security.

ITAR: International Traffic in Arms Regulations

These are a set of US government regulations that control the export and import of defence articles, services, and related technical data. These regulations are administered by the US Department of State's Directorate of Defense Trade Controls (DDTC). ITAR aims to prevent sensitive defence-related technologies from falling into the wrong hands, which could jeopardise national security or undermine US foreign policy objectives.

ITN: Internal Transaction Number

The Internal Transaction Number (ITN) is the AES generated number assigned to a shipment confirming that the EEI was accepted and is on file in the AES.

LoC: Letter of Credit

A letter of credit, also known as a documentary credit, bankers commercial credit, is a payment mechanism used in international trade to perform the same economic function as a guarantee, by allocating risk undertaken by contracting parties.

NLR: No License Required

NLR may be used for either EAR99 items, or items on the CCL that do not require a license for the destination. However, exports of an EAR99 item to an embargoed country, an end-user of concern or in support of a prohibited end-use may require an export license.

OIEL: Open Individual Export License

UK HMRC Open Individual Export Licences (OIELs) are one type of export licence. Specifically, they are a concessionary form of licencing. OIELs are potentially available to individual exporters who have a track record in applying for export licences or who can otherwise demonstrate a business case.

OIELs cover multiple shipments of specific controlled goods to named destinations. They may also name the consignees or end users of the goods concerned - unlike Standard Individual Export Licences (SIELs), which always name these parties.

PL: Pallet List or Packing List

A packing list is a document that includes details about the contents of a package. The packing list is intended to let transport agencies, government authorities, and customers know the contents of the package. These details help each of these parties handle the package accordingly.

POA: Power of Attorney

A power of attorney (POA) or letter of attorney is a written authorization to represent or act on another's behalf in private affairs, business, or some other legal matter. The person authorizing the other to act is the principal, grantor, or donor (of the power). The one authorized to act is the agent or, in some common law jurisdictions, the attorney-in-fact.

RPS: Restricted Party Screening

The United States government and its export regulations restrict or prohibit U.S. individuals and companies from exporting or providing services of any kind to any party contained in U.S. government export denial, debarment, and blocked persons lists.

SAD: Single Administrative Document

The Single Administrative Document (SAD), also known as Form C88 in the UK, is a customs declaration form used in international trade, particularly for imports, exports, and transit of goods within the European Union. It's a standardised form used to declare goods to customs authorities, facilitating trade procedures and data collection.

S.A.S.O: Certificate of Conformity specific to Saudi Arabia

All products require a Certificate of Conformity also referred to as a SASO CoC to enable them to be cleared through Saudi Customs. The Saudi Arabia Conformity Assessment Programme, which covers all goods, has several key objectives: Protection of public health. See our blog here.

SBS: Special Brokerage Services

Customs brokerage services for specialised shipments.

SDN: Specially Designated National

Specially Designated Nationals and Blocked Persons List (SDN) Human Readable Lists. Collectively, such individuals and companies are called "Specially Designated Nationals" or "SDNs." Their assets are blocked, and U.S. persons are generally prohibited from dealing with them.

SED: Shipper’s Export Declaration

A U.S. Shipper's Export Declaration (SED) was a standard United States government form required for all U.S. exports with commodities valued at US$2,500 or higher. The EEI is used by the U.S. Census Bureau to compile trade statistics and exert export controls.

SIEL: Single Individual Export License

A SIEL is a form of UK export licence for controlled goods, specific to one exporter and one consignee. Also see OIEL.

SLI: Shipper’s Letter of Instruction

A Shipper´s letter of instruction (SLI) is a form issued by a shipper to authorize a carrier to issue a bill of lading or an air waybill on the shipper´s behalf. The form contains all details of shipment and authorizes the carrier to sign the bill of lading in the name of the shipper (see Bill of Lading).

STA: Strategic Trade Authorization

A part of the ongoing Export Control Reform is the licence exception Strategic Trade Authorization (STA). This type of U.S. Government authorization allows a controlled item to be exported under defined conditions without a transaction-specific licence.

Keep this guide handy for every-day use. Download the Glossary of Import and Export Terms (pdf format - freshly updated in June 2025).

If you’re feeling confused, don’t worry! Contact us for help.

REQUEST A QUOTE

Fill out our quick and easy form for a no-obligation quote